what happens if my bank returned my tax refund

This is because nobody is holding an account under that account number. What happens if my tax refund is rejected.

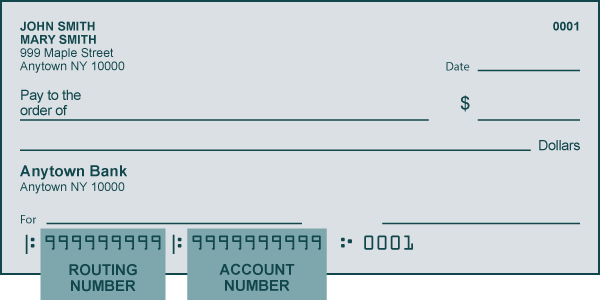

Direct Deposit Of Your Income Tax Refund

In order to be qualified for the rebate state tax returns must have been filed by October 17 2022.

. Generally when someone enters the wrong bank account number on a tax return the refund isnt sent anywhere. The IRS sends CP31 to inform you that your refund check was returned to the IRS. For security reasons we cannot modify the routing number account number or the type of account from what was entered when you filed your return.

Do you have to report interest on checking account. If you havent yet filed your return or if the IRS rejected your return. The IRS is requesting a new address to mail the check.

If you want to change your bank account or routing number for a tax refund call the IRS at 800-829-1040. If you cant update your mailing address online. If the account is closed the bank.

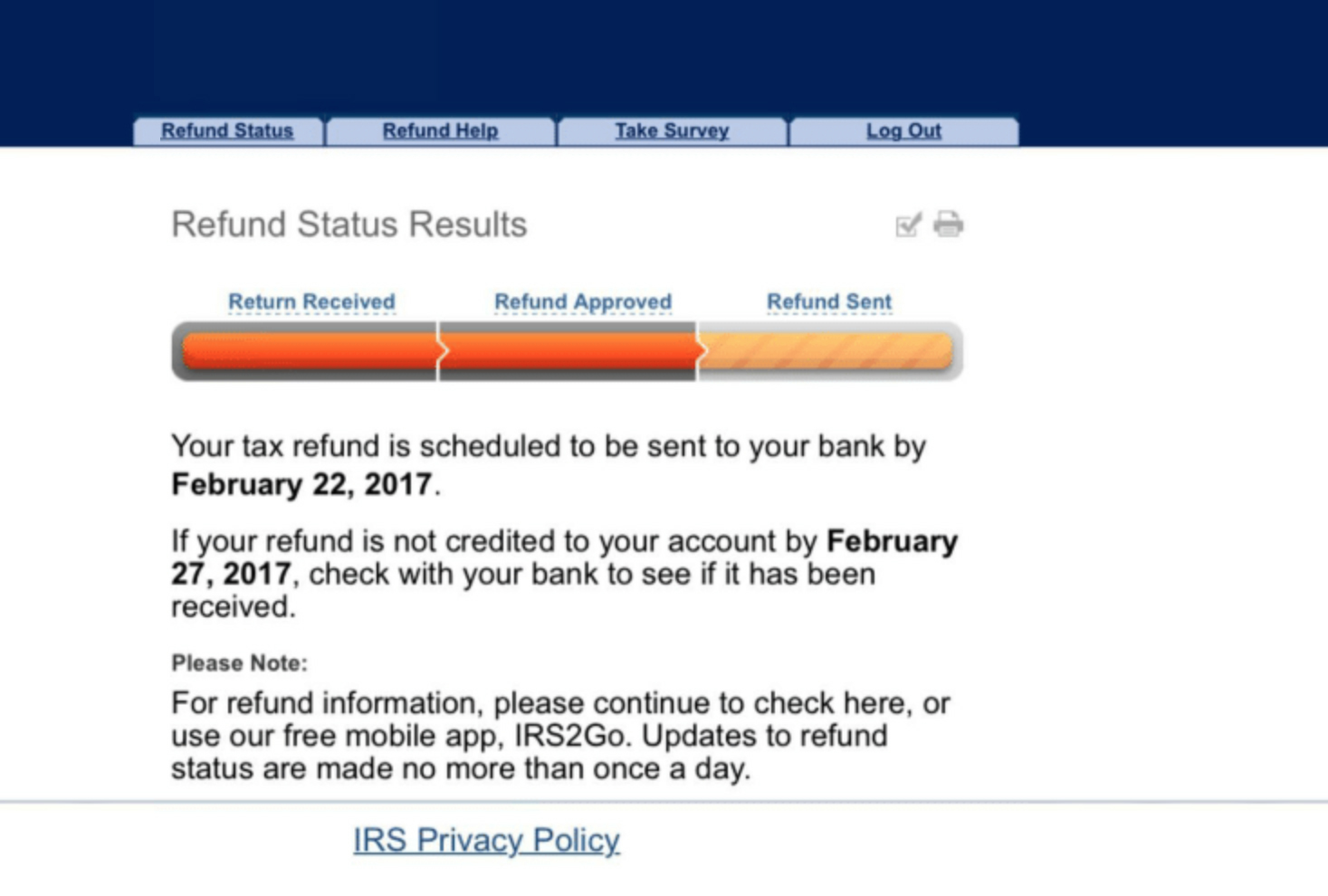

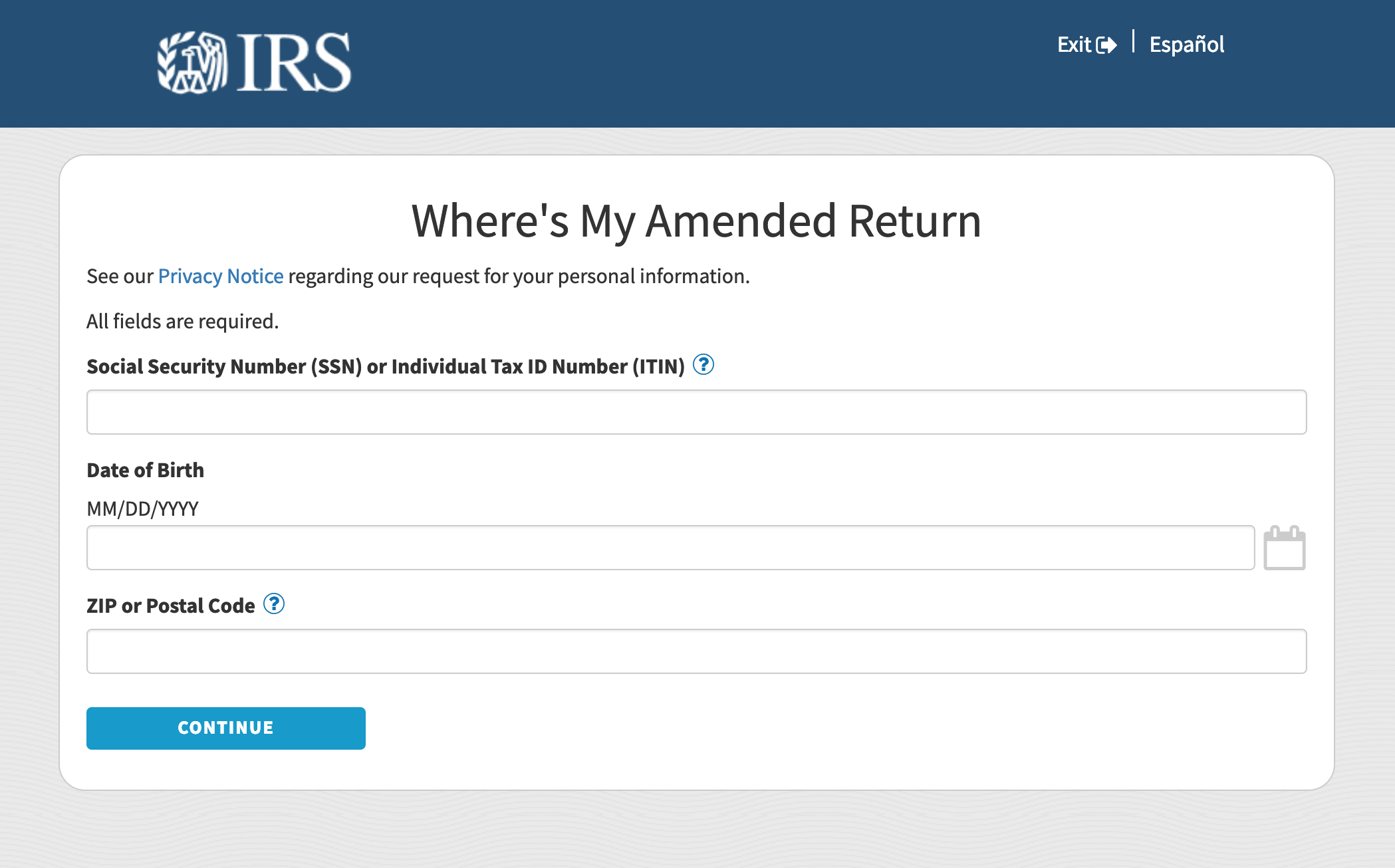

Report the Fraud Quickly. It will be sent back to the Internal Revenue Service if it is refused because the account information does not correspond to the. The Irs updated my wheres my refund on the 27th monday saying it was returned and will be mailed by mar 6 and if not recieved by apr 3 to call back.

This includes interest on checking. If you incorrectly enter an account or routing number that belongs to someone else and your designated financial institution accepts the deposit you must work directly with the. Answer 1 of 8.

Any unpaid taxes child support or other types of debt may impact the. In a week or two. Call the IRS Identity Protection Specialized Unit at 800-908-4490 right away so that they can begin the process of verifying your information.

On the 6 monday it was. If the return hasnt already posted to our system you can ask us to stop the direct deposit. Yes interest income that is not specifically tax-exempt would be taxable on your return.

If the third party bank is unable to deposit to the account provided they will either mail you a check or return the refund to the IRS. When that bank refuses the direct deposit where it goes back to depends on where it was from. Your bank should return it back to the US Treasury IRS They will then cut a paper check to your address of record.

You may call us toll-free at 800-829-1040 M - F 7 am. If the direct deposit was directly from the IRS the bank would send it back to the IRS who would.

:max_bytes(150000):strip_icc()/Balance_Tax_Refund_Status_Online_1290006-9f809670a73041a7a6caa96dd5592c99.jpg)

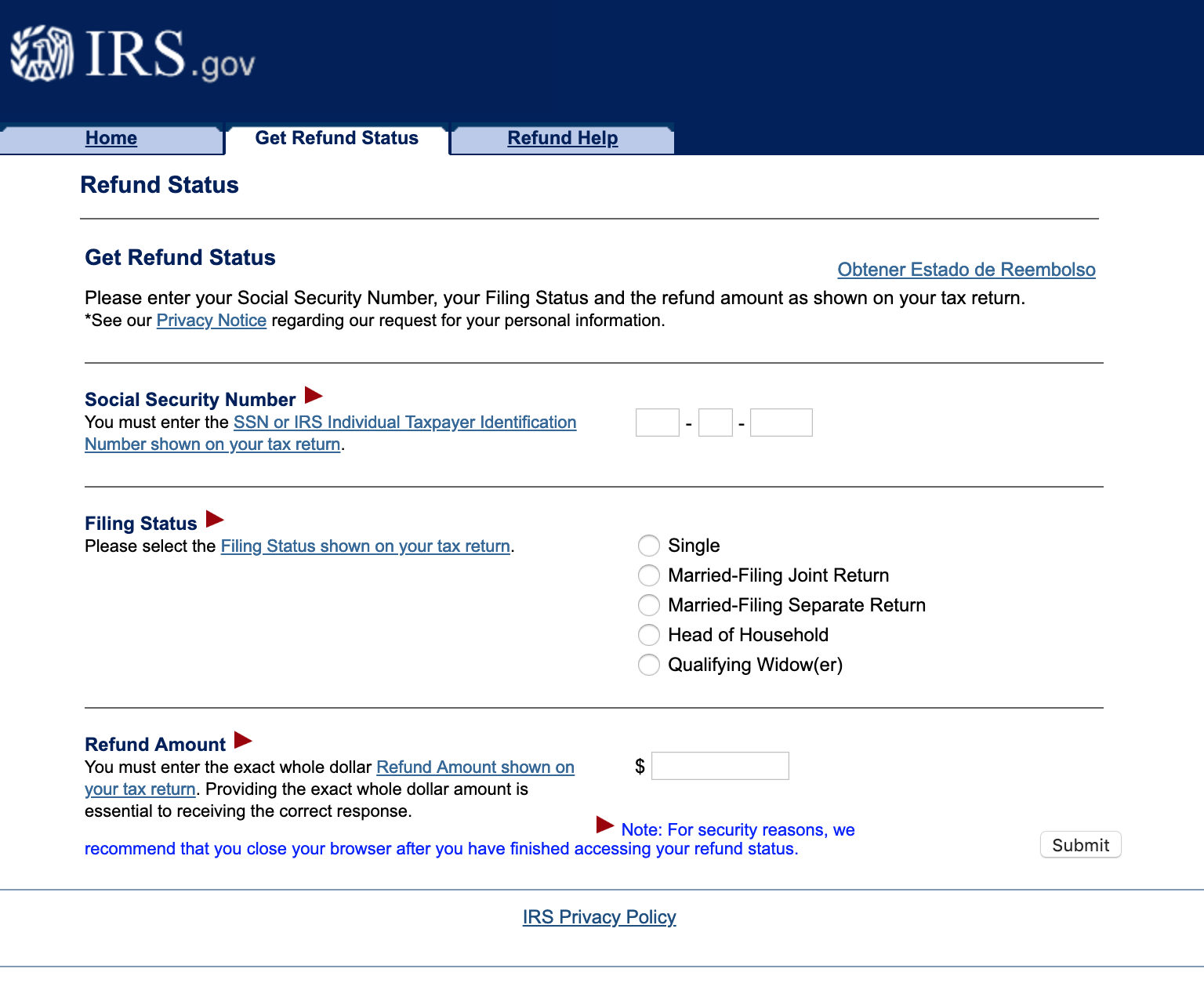

Trace Your Tax Refund Status Online With Irs Gov

Track The Progress Of Your Tax Return In Australia One Click Life

Where S My Tax Refund The Irs Refund Timetable Explained Turbotax Tax Tips Videos

Steps To Verify Itr Online Using Axis Net Banking Tax2win

How To Check Your Irs Refund Status In 5 Minutes Bench Accounting

How To Check Your Irs Refund Status In 5 Minutes Bench Accounting

Neither Received A Refund Or Owed Money R Irs

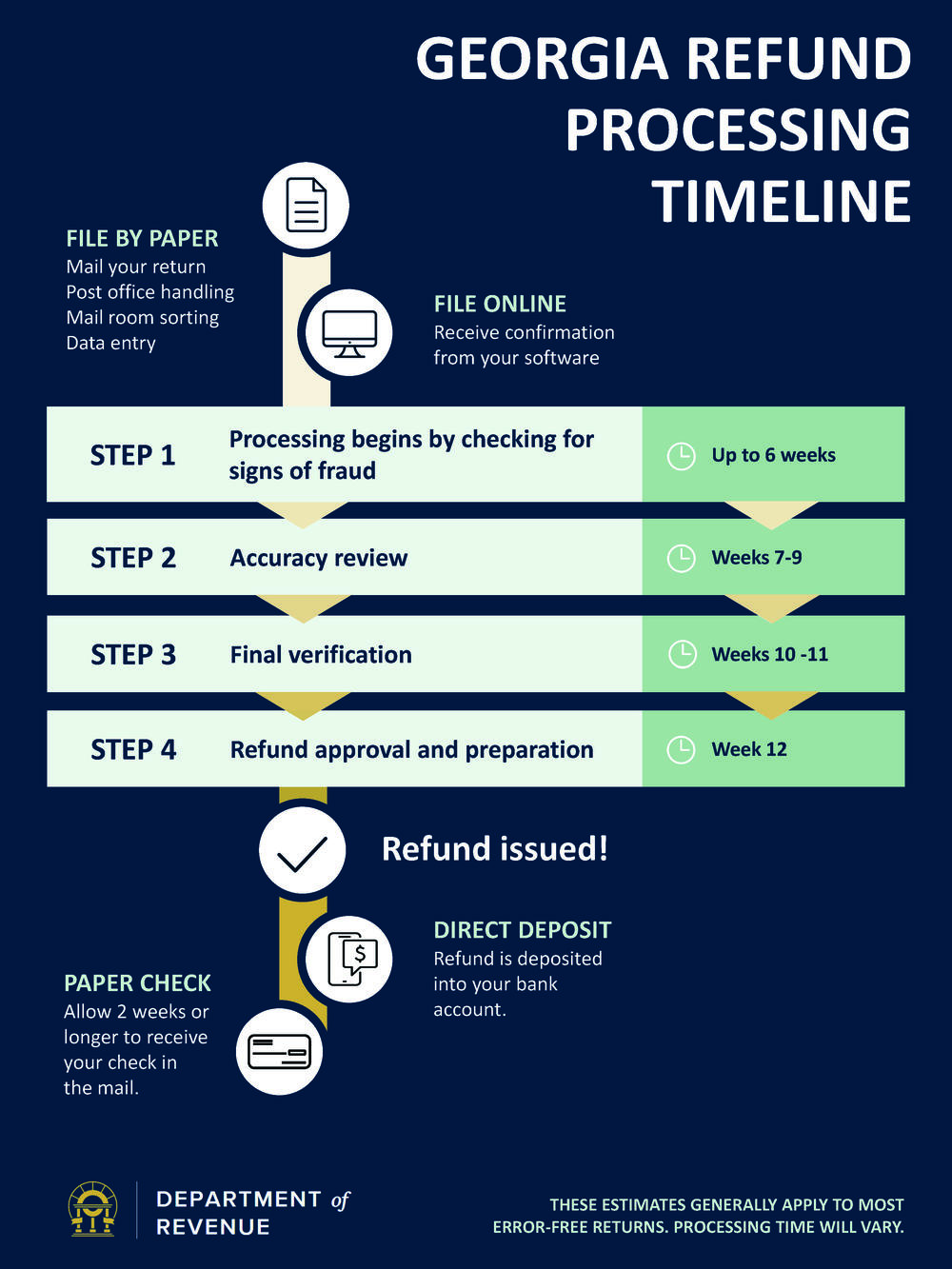

Check My Refund Status Georgia Department Of Revenue

No Tax Refund Yet Why Your Irs Money Might Be Late Cnet

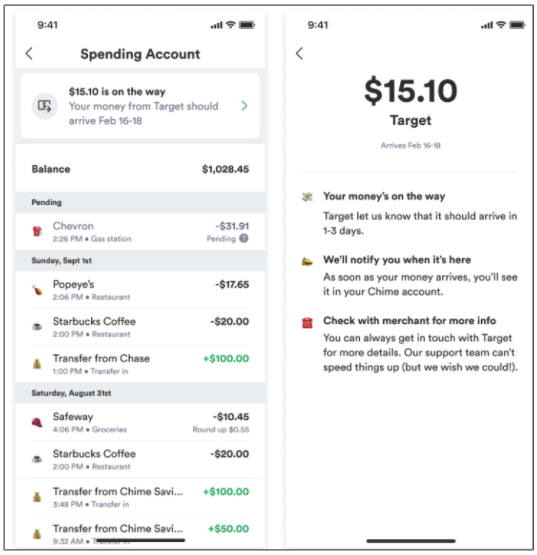

When Will I Get My Refund For A Purchase I Made Help

Where S My Tax Refund When To Expect Your Money And How Much Extra The Irs Owes You Cnet

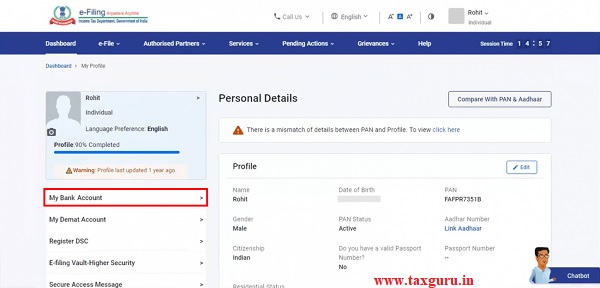

All About Pre Validate Bank Account On Income Tax Website

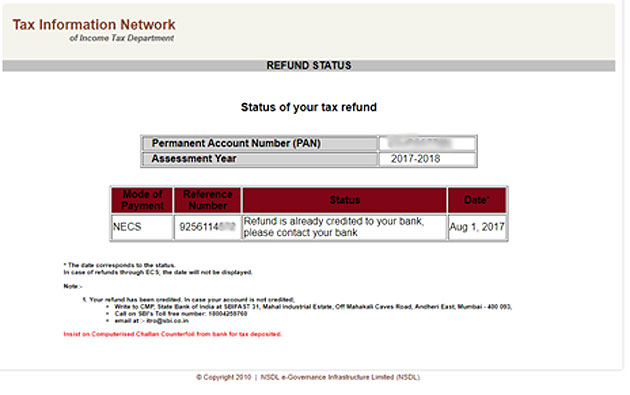

Income Tax Refund Status How To Check Income Tax Refund Status

How Do I Claim Back Tax If I Complete A Tax Return Low Incomes Tax Reform Group

Irs Tax Tracker How Long Does It Take For Irs To Approve Refund Marca

Set Up Direct Deposit With The Irs When You File Today Here S Why Cnet

Why Is It Taking So Long To Get My Tax Refund Irs Processing Backlog Updates Aving To Invest

How To Check Your Irs Refund Status In 5 Minutes Bench Accounting

2022 Tax Refund Schedule When Will I Get My Refund Smartasset